After a strong finish to 2021, market performance during the first couple of months of 2022 has been choppy to say the least. While market volatility is par for the investing course, it is still unsettling, particularly when it is higher than average. Russia’s invasion of Ukraine on February 24th further contributes to market volatility, and it is likely that we’ll continue to witness heightened levels of market fluctuations for some time as the world digests the implications of a significant disruption to world peace.

“It is particularly important at times like this that investors ensure their investment portfolios are aligned with their investment horizon”, says David Udy, CEO and Founder of WealthCo. “Investments which may be required for consumption over the next six to twelve months should be avoiding both equities and bonds, since stock returns will likely be very uncertain while bond returns may well be negative should inflation continue to climb. However, for investors with investment horizons of three years or longer, history has shown that these periods of stress are typically periods of attractive valuations and opportunities.”

Exiting markets in periods of heightened volatility may seem tempting, but rarely is it evident for ‘market-timers’ as to when to re-enter the market…leaving them frustrated and confused.

What is Behind this Latest Round of Market Volatility?

There are three key factors that have been wreaking havoc on the market this first quarter.

1. Russia’s Invasion of Ukraine

Russia has been setting the stage for a large-scale invasion of their Ukrainian neighbours to the southwest through most of 2022 and finally proceeded on February 24th. Global equity markets were uncertain about what path the Russia-Ukraine conflict would take, but they had generally priced in some unanticipated turmoil during the first seven weeks of the year, with global stock markets falling roughly 10% prior to February 23rd.

“We live in a very globalized world,” Stephen Logan, WealthCo Senior Financial Analyst, shares. “Geopolitical conflict in Russia-Ukraine could hurt the economies of surrounding European nations. In turn, this can lead to ripple effects impacting the North American economy. Political instability is a risk factor that can cause investor sentiment to become increasingly bearish but can also result in discounted investment opportunities. WealthCo’s portfolio is diversified across global markets, including North America, Europe, and Asia, and does not have any direct holdings in either Russia or Ukraine."

2. The Hits Keep Coming for Supply Chain

Canada’s trucker convoy was disbanded following an unprecedented enacting of the Emergencies Act. However, a good portion of the damage had been done supply-chain-wise. Our on-demand society was already struggling to adjust to the many product shortages resulting from, what has been coined, the Great Supply Chain Disruption. The convoy blockades that interrupted key US-Canada border crossings, including Ontario’s Ambassador Bridge and Alberta’s Coutts border crossing, just piled on to this already existing headache. The impacts to the Ambassador Bridge crossing alone were substantial considering that this corridor is responsible for 25% of cross-border trade, to the tune of $360 million per day.

“Supply Chain shortages in North America have allowed us to be opportunistic with our investment pipeline,” Logan points out. “For example, we’ve recently invested in warehousing and logistics facilities along the US/Mexico border through our investment partners at ICM. Adding these types of investments, especially when markets are looking for a solution to their supply chain issues, has the potential to deliver strong results for WealthCo’s portfolio.

3. Inflation is on the Rise

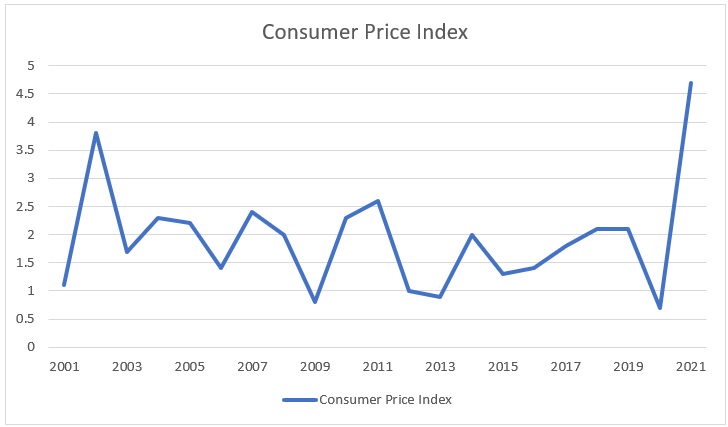

A simple trip to the local grocery store will confirm that inflation is indeed on the rise. For those Canadians who are in the process of buying real estate, inflation, coupled with demand shortages, has created a bidding war circus in many parts of the country.

Inflation in Canada hit a 30-year high last month, at 5.1%. Across the border, the US hit their own 30-year high at 7.5%. In an attempt to better stabilize the economy from this erosion of the purchasing power of our currency, banks respond by increasing lending rates, which in turn curbs consumer spending. Russia’s invasion of Ukraine will likely further fuel short-term inflationary pressure, particularly with regard to energy prices.

“WealthCo’s investment portfolios attempt to mitigate inflation risks by investing in real estate and infrastructure assets,” Logan advises. “Income streams generated from these types of investments tend to adjust well with inflationary pressures. Additionally, many of our private debt investments are structured on floating rate terms. This means as central banks increase overnight lending rates, these investments will adjust their rates accordingly."

Given that many are predicting that we’ll see upwards of four interest rate hikes in 2022, and given that prices fall when interest rates increase, WealthCo has opted for short duration in our core fixed income portfolio. “Duration is the measure of price sensitivity of a fixed income security to changes in interest rates. Higher duration means greater sensitivity,” Logan explains. “The WealthCo Fixed Income Fund currently has a duration of 4.2 vs our benchmark of 8.3. This means that changes in interest rates will likely have less of an impact on our portfolio compared to the broader Canadian market."

Why We Remain Cautiously Optimistic

Fortunately, it’s not all doom and gloom, despite this unique period of time where Russia’s unprecedented actions, supply chain issues, and inflation seem to be closely colluding in an attempt to impose sleepless nights on investors.

“Overall, our outlook for the year remains cautiously optimistic. We are well diversified and we’re making sound and proactive investment decisions based on changing market factors, and we view recent market volatility as an opportunity to make future investments at more reasonable valuations.”

If you’d like to schedule a portfolio review, please reach out or talk to your financial planner or CPA.

Related Posts