For the first time in decades, rapidly rising inflation has emerged around the world. The annual increase in the US Consumer Price Index to July 2022 was 8.3% with the Canadian increase not far behind (7.6%). We have not seen these rates of inflation since the early 1980s, and they have impacted every family, every business, and every government around the world. High inflation also impacts investment portfolios, but certainly not equally. Some investments may thrive in an inflationary environment while others may decline in value.

What’s driving inflation in 2022?

Whether we are shopping at the grocery store, filling our gas tanks, managing a business, or looking for a place to vacation, everything seems so much more expensive than before. A perfect storm of events has contributed to the situation, including:

- A prolonged pandemic which increased costs for some items and businesses, but also increased pent-up demand for families who were not able to consume as they were accustomed;

- Significant supply chain challenges that delayed imports of a wide variety of goods;

- Russia’s invasion of Ukraine which significantly reduced the world’s supply of energy;

- A shrinking labour market as the population continues to age and an increasing number of boomers are electing to leave the workforce; and

- Record low interest rates through 2020 and 2021 to help stimulate the economy and encourage growth.

Let’s discuss each of these in turn.

How Supply and Demand Impact Inflation

The first part of the first lecture in any Economics 101 class teaches students about supply and demand.

The fundamental relationships are simple. The price of a good or service is determined when the quantity demanded equals the quantity supplied.

But when demand goes up, price goes up

As Omicron fears faded, many consumers caught up on shopping, travelling, and spending…thus increasing prices

When supply goes down, price goes up

The supply chain challenges of late 2021 which persisted into 2022 increased prices as well. Impatient consumers were willing to pay more and suppliers found it relatively easy to pass along higher prices

Input Costs Drive Prices

The second half of an Economics 101 lecture likely reminds us that the starting price of goods and services is driven by the costs to provide a good or service.

Energy costs are a key input for all goods and services. The price of oil returned to pre-pandemic levels early in 2021 and continued to climb higher as demand began to increase amidst supply restrictions driven by green-energy policies. When Russia invaded Ukraine in February, energy inflation soared and has been the primary driver of inflation in 2022.

Labour costs are a key input for most goods and services. Unemployment rates across the United States and Canada are extremely low, with many employers searching desperately for workers in multiple sectors. As workers continue to exit the workforce, upward pressure on wages will continue which will further increase the pressure on inflation.

Why central banks are motivated to control inflation

Over the last few decades, major central banks have managed to keep inflation rates at or below a target of 2%. Maintaining a modest, but not significant, level of inflation is widely viewed as the best way to maintain and grow our economies at a reasonable level.

Inflation that is too low, or deflation (negative inflation), isn’t good for economies. If people believe that prices will be lower in future, they are likely to defer consumption. Producers respond by cutting back production, and the economy risks spiraling downward.

Inflation that is too high isn’t good for economies, or individuals, either. Inflation tends to be hardest on lower-income families and can significantly reduce their standard of living. And it contributes to a nasty spiral where consumers are motivated to spend earlier in anticipation of higher prices in future, then push for higher wages, which contributes to higher costs, which encourages even more spending, etc.

When consumers and producers expect inflation to continue at a modest rate, the cycle of growth and production typically remains relatively stable. That’s why central banks and policy makers are motivated to get inflation under control.

Short-term Interest Rates Drive Inflation

While pent-up demand, tight labour markets, supply chain challenges, and soaring energy prices have all contributed to the rise in inflation, the loose monetary policies which we saw during the pandemic were a key contributor to this perfect storm. When we speak of ‘loose’ monetary policies, we are referring to central banks tendencies to lower key interest rates. Lower interest rates encourage companies and consumers to borrow more money to produce more goods/services and/or consume more. These policies were crucial to keep our economy afloat during 2020 and 2021 when COVID concerns were highest.

But as 2022 emerged, those lower interest rates quickly transitioned from the solution to the problem. Consumers and corporations had too much ‘easy’ money to spen …and prices started to soar. History has shown us that raising interest rates is an extremely effective tool to reduce consumer demand and eventually control and reduce inflation, and that is what we currently seeing. It is fair to say that we will continue to see short-term interest rates rise until there is evidence that inflation is under control. Controlling inflation via raising interest rates without triggering a recession will be tricky, but that’s the goal.

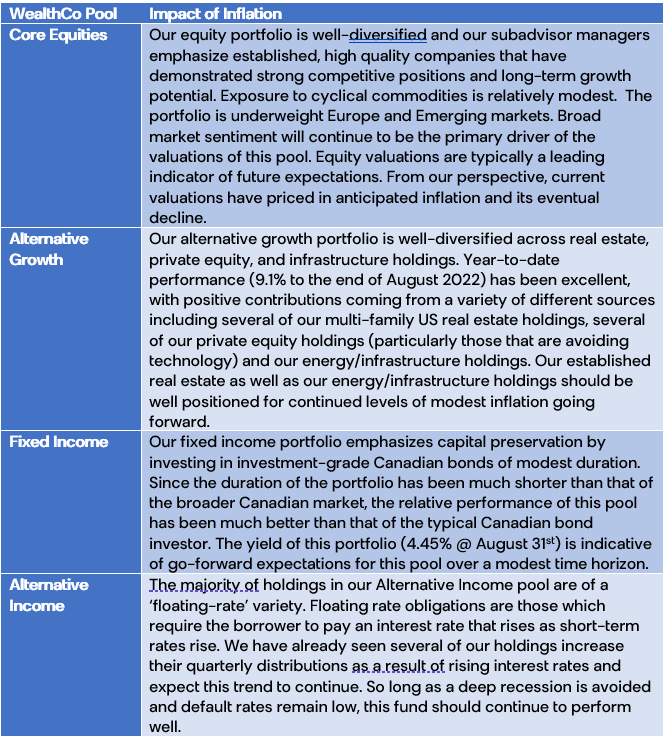

How inflation impacts WealthCo’s investment pools

Inflationary pressures impact different investments in different ways, and the impact isn’t always as anticipated (since market prices combine elements of uncertainty, speculation, and emotion). But in general, we share the following:

Overall, controlling and managing inflation is crucial to the ongoing growth and stability of our local, national, and global economies. While controlling it will be painful for some, it is necessary and will, in the long-term, be beneficial. We are pleased with our diversified exposure to inflationary drivers across the portfolio and anticipate above-average levels of inflation over the next few years. Especially for investors with a consumption horizon of three-five years or longer, we continue to be comfortable recommending fully-invested diversified exposures across multiple asset classes. From our perspective, GICs and short-term savings vehicles simply lock-in negative rates of return (i.e. rates of return less than inflation) and should only be encouraged for capital that investors expect to consume/spend in the shorter term.

About the Author | Dave Makarchuk

This Market Commentary is written by WealthCo Asset Management's Chief Investment Officer, Dave Makarchuk. Dave brings over 20 years of institutional investment experience to the WealthCo team as well as several credentials including CFA, FCIA, and FSA designations.

When he’s not using his critical thinking and problem-solving skills to further enhance WealthCo’s investment portfolios and improve investor outcomes, you’ll find Coach Dave on the ice, training the next generation of Canadian hockey players.

About WealthCo Asset Management

WealthCo Asset Management is a member of the Integrated Advisory Community and The WealthCo Group of Companies. The WealthCo Group of Companies works exclusively with Canadian CPA professionals and their clients through the Integrated Advisory community. With over 20 years’ experience collaborating with progressive CPA's and industry specialists, we are dedicated to working alongside our accounting partners to offer a holistic and integrated wealth planning experience to their clients. Please note, past performance is not indicative of future results.

Related Posts