Remote work - a working model that was in existence prior to COVID-19, but certainly has the pandemic to thank for its rapid heightened adoption – has proven its staying power beyond the days of widespread lockdowns. In 2016, only 4% of Canadians worked from home. Now, 20% of Canadians work remotely. Which has some implications when it comes to tax time.

With more Canadians engaging in work from home setups and freelance or contract work arrangements outside of a traditional office environment, the government has been challenged to update their legislation and implement effective tax measures.

Tax Considerations for Hybrid and Remote Employees

With upwards of 40% of the Canadian working population having been required to work from home during the pandemic, the government introduced two tax deduction options for those remote workers, the temporary flat rate method and the detailed method.

The Temporary Flat Rate Method

The temporary flat rate method was introduced in 2021 and has been extended to the 2022 tax year. This method allows a $2.00/day claim for each day worked from home in 2022, up to $500 (for 250 working days). In order to be eligible, an employee must have worked from home for more than 50% of the time, for at least four consecutive weeks, due to the pandemic. This amount can then be claimed on Form T777S and added as a deduction on your income tax return on line 22900 (“other employment expenses”). When calculating your ‘days worked from home’ make sure to exclude any statutory holidays, sick days, and vacation days from your calculation.

The Detailed Method

This second (and more involved)detailed method option requires that claimants meet the following criteria, eligibility-wise:

- Worked from home in 2022 due to the pandemic (note, this applies whether your employer gave you the choice or not and does not need to be made a part of your employment contract);

- You spent more than 50% of the time in your home work space for at least four consecutive weeks in 2022; and

- You have a completed and signed copy of Form T2200S or T2200 from your employer.

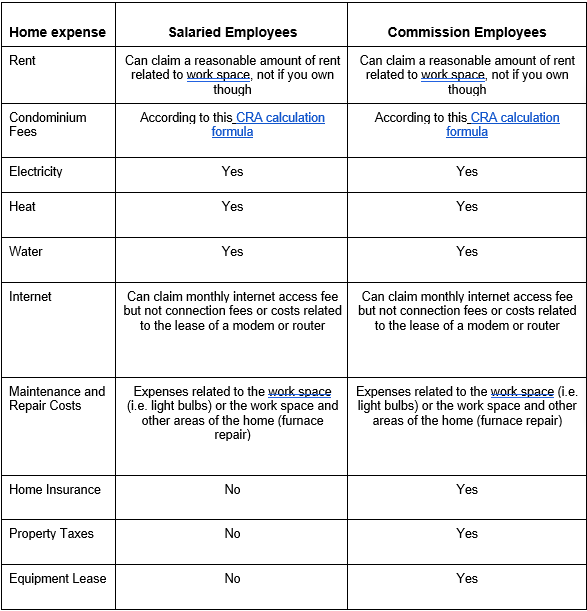

With the detailed method, a certain portion of home-based expenses can be claimed as per the table below.

Tax Considerations for Business Owners

The CRA dictates that if you use part of your home for both your business and personal living, tax eligible deductions can be calculated by determining “how many hours in the day you use the rooms for your business, and then divide that amount by 24 hours. Multiply the result by the business part of your total home expenses. This will give you the household cost you can deduct. If you run the business for only part of the week or year, reduce your claim accordingly.”

Eligible vs Ineligible Home Office Expenses

The list of eligible vs ineligible tax deductions for business owners and the self-employed is complex and may vary based on your industry and profession and is therefore best left in the capable hands of your accountant. When it comes to home-based expenses, as in the case of remote working employees, many of these expenses (including heat, water, internet, electricity, property taxes, garbage and recycling pickup) are eligible, as well as mortgage interest for those who own their homes. In order to calculate how much of this total expenditure is eligible, the CRA advises determining how much of your home is used for personal space, and how much is used for business purposes, and then divide the area used for business by the total area of the home, multiplied by total expenses. Like, in this example below:

Stacey is a management consultant who lives in a 2,000 square foot home. Her office, which accounts for 15% of the space in her home, is 300 square feet and is solely used for business purposes. Stacey’s annual household expenses total $8,000.

300 square feet/2,000 square feet = 0.15

0.15 X $8,000 = $1,200

Stacey can deduct $1,200 in household expenses as Business Use of Home Expenses against her business income. Note that if she has incurred a business loss, these expenses cannot be used to further increase her loss but instead are carried forward and can be deducted from business income earned in a future year.

It should be noted that the principal portion of the mortgage is not eligible for deduction. It should also be noted that if the space in question is used personally in addition to being used for business space, this percentage will need to decrease accordingly.

Your Best Bet for Navigating Tax Season

At the end of the day, your best bet for ensuring compliance with the CRA and maximizing any and all prospective tax deductions is to work with your most trusted advisor, your accountant. When it comes to filing your taxes, there is much at stake and having a qualified accountant can bring invaluable peace of mind. They will understand the intricacies of the CRA’s regulations and be able to minimize any potential problems.

The Integrated Advisory Network consists of progressive CPA firms, along with best-in-class professional advisors, service, and product specialists, who work together to deliver an elevated and holistic client experience. One that optimizes both their personal and professional lives with an integrated financial strategy designed to help clients reach their goals.

Related Posts